Jumpstart is first-of-its-kind earthquake insurance for HOAs in California, Oregon, and Washington. We pay lump-sum funds immediately after an earthquake with no deductible. Money can be used as-needed for recovery in individual units and/or shared common areas.

Condominium residents are in the unique position of relying on each other after an earthquake. Your speed of disaster recovery is intertwined with the actions of other residents. Earthquake damage in each condo unit is often similar across units, and earthquake damage in common areas can affect the entire building or complex.

Your HOA can be more financially prepared for an earthquake and minimize assessments to unit owners with Jumpstart.

What benefits does Jumpstart offer HOAs?

Jumpstart makes innovative parametric insurance newly-available for Homeowners Associations, condos and shared living. Features include:

- Fast payout

- Start repairs right away and prevent follow-on damage.

- Whether you buy regular quake insurance or not:

- Jumpstart can be purchased as a stand alone policy. Many HOAs decline regular earthquake insurance because of the cost or the high deductible.

- You can buy Jumpstart even if the HOA already buys earthquake insurance. In this case, Jumpstart can help offset the large deductible or pay for landscape damage or other exclusions.

- Reduce the chances of post-quake HOA assessments.

- Use the funds for any extra expense needed to recover, such as:

- Securing the building

- Repairing cracks in shared spaces

- Relocation funds for residents

- Landscaping

- Repairing gas, water, and power lines.

How much coverage can we buy?

The amount of lump-sum payment is the number of units * the per-unit coverage. The HOA decides how much coverage to buy per unit, from $2,000 to $10,000 per unit.

For example, a HOA could decide to purchase $5,000 of coverage per unit for 50 units. Following a large earthquake that triggers a payout, the HOA would receive $250,000 right away, to use for any expenses caused by the earthquake.

Policies are held by the HOA, and the HOA determines how to allocate the funds. Funds can be used to repair common spaces, or they can be allocated directly to unit holders for personal expenses or for repairing interior damage.

Bonus: Structural Engineering Evaluation Report

Part of preparing your HOA for an earthquake is assessing the structural safety of your buildings. Through Jumpstart, your HOA can obtain a basic structural engineering report, prepared by a licensed structural engineer with whom we partner, for a small fee. The report will describe the seismic strengths and vulnerabilities of the building(s), identify any suggested structural upgrades, and help your HOA decide how much and what type of earthquake insurance to buy.

If you’d like to learn more about a structural engineering evaluation for your HOA, please leave your information in the contact form below.

What else?

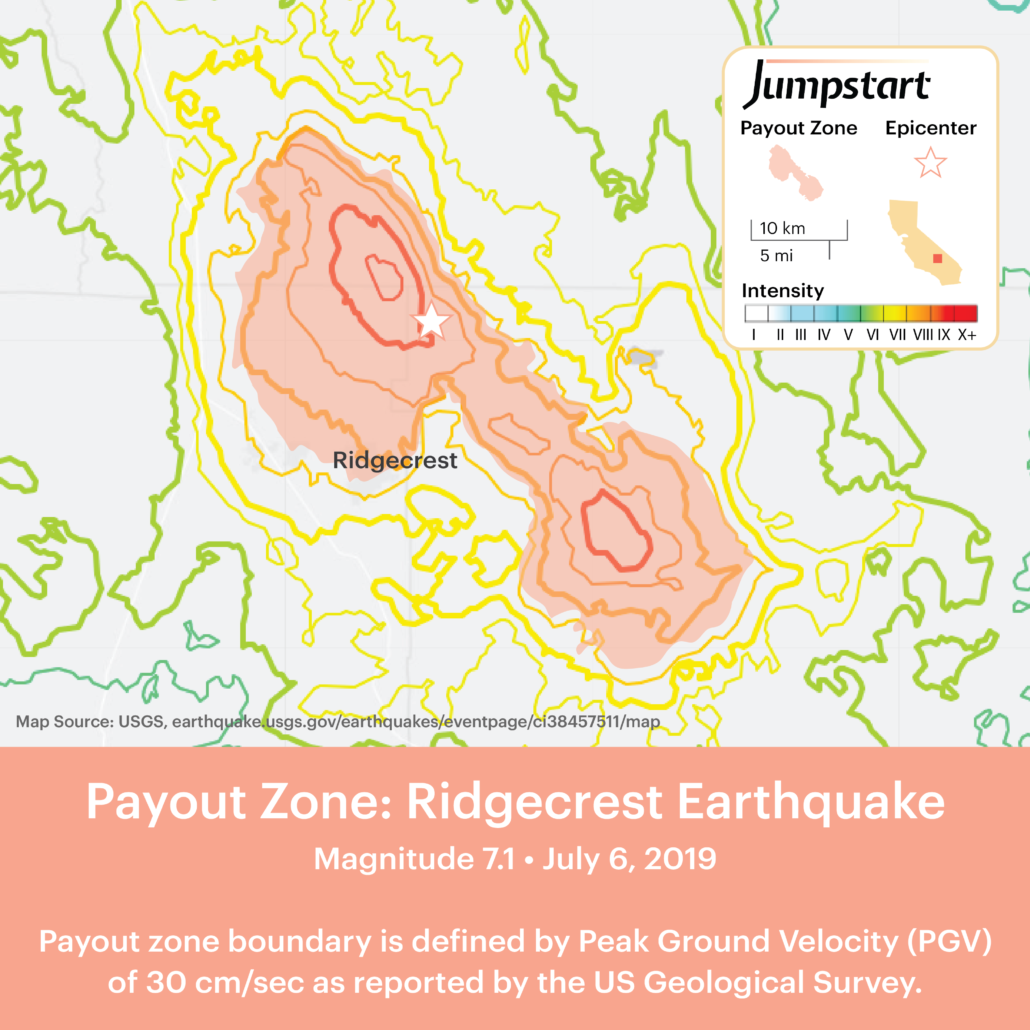

- Our parametric insurance is triggered by transparent public data from the USGS. Payouts occur when shaking intensity exceeds PGV 30 cm/sec, roughly equivalent to the ‘red zone’ of the USGS shake map. Read our post for more information regarding what would trigger a payout event.

- Customers in the payout zones are notified the day after the event. Once notified, customer responds with a simple text message to confirm that they have expenses.

- The full value of the policy is sent right away to begin recovery – Jumpstart has no deductible, claims adjusters, paperwork, or hassles.

- Jumpstart is available in all ZIP codes of California, Oregon, and Washington.

- Read our FAQs for more information

Do you have other products available?

Yes! Our standard $10k policy can be bought by any renter, homeowner, or condo resident. We also have special products for:

How can I buy Jumpstart earthquake insurance for my HOA?

HOA policies are not yet available on our website but you may leave your information below, call us at 510-891-1753, or email us at [email protected] and we will reply as soon as possible. Jumpstart is available throughout California, Oregon, and Washington.

Jumpstart Insurance Solutions Inc. – Regulated by and in full compliance with the California Department of Insurance.

Effected with certain Underwriters at Lloyd’s, London, A Rating by AM Best.