Jumpstart is unique type of earthquake insurance in California, Oregon, Washington. We pay our customers a lump-sum immediately after a large earthquake, to be used as-needed for recovery, whether or not there is physical damage. Your nonprofit can be more financially prepared for an earthquake with a Jumpstart policy – purchased or donated.

Some individuals buy a Jumpstart policy as a donation to a school PTA or other nonprofit organization. This means the organization will receive $10,000 immediately after an earthquake. Many schools or nonprofits may be in the unique position of offering post-disaster aid or assistance. With an extra $10,000 available, there will be less need for the organization to dip into its operating budget.

What benefits does Jumpstart offer non-profits?

Jumpstart is the first to make parametric insurance widely available in California, Oregon, and Washington. Features include:

- Fast payout

- Immediate availability of post-disaster funds

- Flexible use of funds

- Repair damage to facilities if there is damage

- Fund post-disaster aid programs

- Whether you buy regular quake insurance or not:

- Jumpstart can be purchased as a stand alone policy. Many organizations decline regular earthquake insurance because of the cost or the high deductible.

- Jumpstart can be purchased even if the organization already buys earthquake insurance. In this case, Jumpstart can help offset the deductible or pay for expenses not covered by the insurance.

- Financial robustness:

- Reduce the chances of dipping into operating budget

- Reduce the chances of drawing down reserves.

How does our school or nonprofit qualify?

The organization can purchase a policy for themselves or ask a donor to purchase a policy on their behalf. Coverage amounts are either $10,000 or $20,000. This means, after a large earthquake that triggers a payout, the organization would receive either $10,000 or $20,000 right away, to use for any expense attributable to the earthquake.

Policies are held by the organization, and the organization determines how to allocate the funds.

What else?

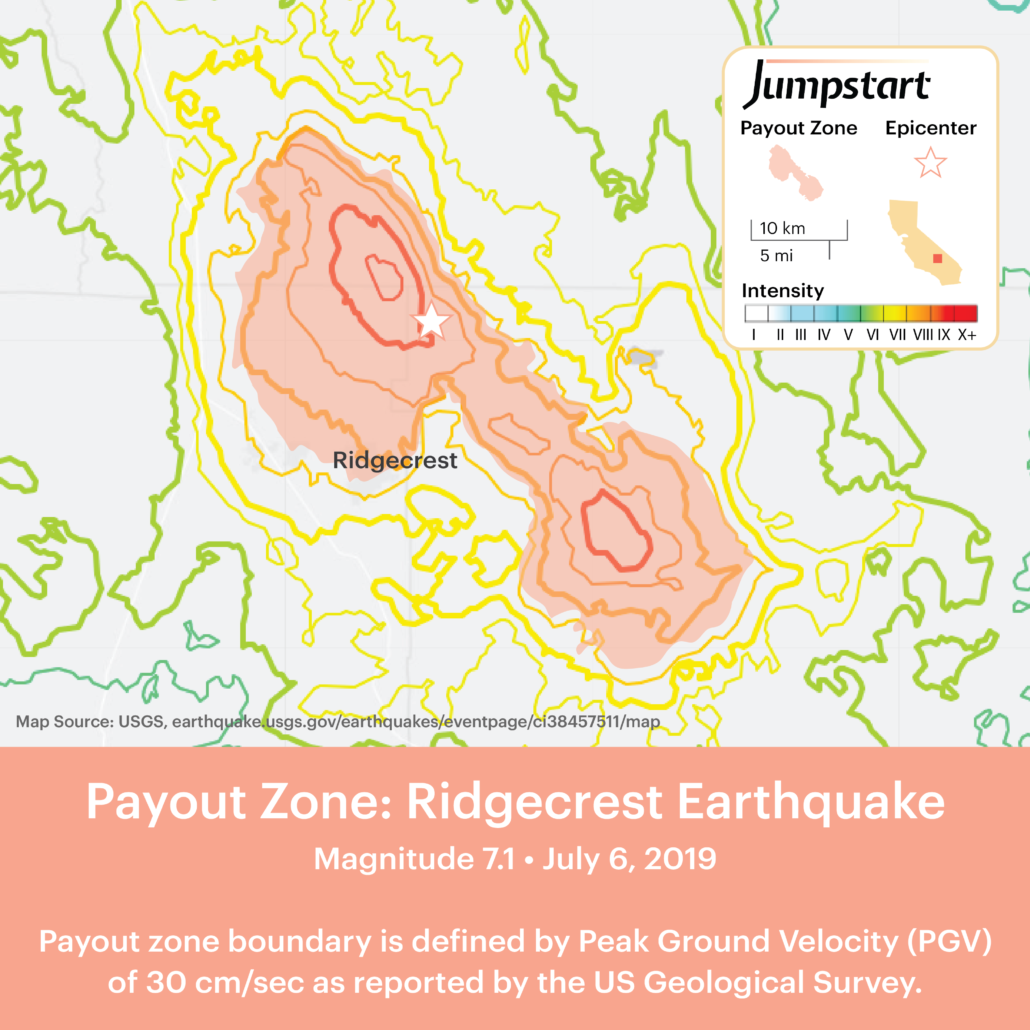

- Our parametric insurance is triggered by transparent public data from the USGS. Payouts occur when shaking intensity exceeds PGV 30 cm/sec, roughly equivalent to the ‘red zone’ of the USGS shake map. Read our post for more information regarding what would trigger a payout event.

- Customers in the payout zones are notified the day after the event. Once notified, customer responds with a simple text message to confirm that they have expenses.

- The full value of the policy is sent right away – Jumpstart has no deductible, claims adjusters, paperwork, or hassles.

- Jumpstart is available in all ZIP codes of California, Oregon, and Washington.

- Read our FAQs for more product information

- Read our Company Overview for additional information

Do you have other products available?

Yes! Our standard $10k policy can be bought by any renter, homeowner, or condo resident. We also have special products for:

How can I buy Jumpstart earthquake insurance for my organization?

Organizational policies are not yet available on our website but use the contact form below, call us at 510-891-1753 or email us at [email protected] to purchase a policy or with any questions.

Jumpstart is available throughout California, Oregon, and Washington.

Jumpstart Insurance Solutions Inc. – Regulated by and in full compliance with the California Department of Insurance.

Effected with certain Underwriters at Lloyd’s, London, A Rating by AM Best.